With dozens of Medicare plans on the market ranging from Original Medicare to popular Medicare Advantage plans, selecting coverage for 2024 can get overwhelming fast. What helps is understanding how to compare Medicare options to find plans suiting your healthcare needs and budget.

This 2024 Medicare guide covers smart steps for navigating choices this year. It also shares tips for getting financial support to afford premiums and out-of-pocket expenses, no matter which plan you ultimately select.

– Advertisement –

Evaluate if You Prefer Original Medicare or Medicare Advantage

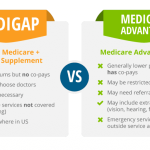

The first big choice boils down to Original Medicare or Medicare Advantage. Here’s how both route options work:

Original Medicare consists solely of Part A hospital coverage and Part B medical coverage. Those with just Original Medicare usually supplement by purchasing standalone Part D prescription drug coverage plus an option like Medigap to pay copays, coinsurance and deductibles.

Medicare Advantage plans incorporate all the coverage of Parts A, B and often D into one plan you purchase from private insurers. Many Medicare Advantage plans have $0 premiums or low premiums not exceeding Original Medicare’s costs. Types of Medicare Advantage plans include HMOs, PPOs, Private Fee-for-Service plans and Special Needs plans.

When deciding between the two routes, compare plan costs, benefits offered, provider access, prescription drug coverage, convenience factors and insurance protections. Weigh your total health needs to discern if Original Medicare or Medicare Advantage plans make most sense this year.

Take Time to Compare Standalone Medicare Part D Plans

Even if you won’t ultimately use a separate Part D plan based on if you have drug coverage via Medicare Advantage, it helps to compare options. Why? It shows what prescription drug plans cover in your area at what prices – great insight for comparing Medicare Advantage plans with built-in Part D benefits.

Here are key steps for comparing 2024 Part D Prescription Drug plans:

- Use Medicare’s online Plan Finder to enter your medications and preferred pharmacies to see plan matches.

- Compare monthly premiums, deductibles, copays/coinsurance and the coverage stage you’d land in based on expected medication costs.

- Ensure preferred pharmacies are in-network and see if plans require prior authorizations or have quantity limits affecting drug access.

- Enroll during Medicare Open Enrollment from October 15th to December 7th for 2023 plan activation.

While standalone Part D plans make sense for some, others may benefit from Medicare Advantage plans with prescription drugs included.

Leverage Expert Guidance to Choose Medicare Advantage Plans

Rather than struggle through comparisons alone, connect with resources providing experienced Medicare advice:

- Medicare Brokers can explain plan specifics like networks, pricing and benefits to pinpoint suitable matches.

- State Health Insurance Assistance Programs (SHIPs) offer free one-on-one Medicare counseling.

- Calling 1-800-MEDICARE lets you speak to a representative addressing questions.

- The federal Medicare Plan Finder details plan pricing, formularies, ratings and more to compare.

Guidance from Medicare resources helps simplify the process of choosing between Original Medicare vs. Medicare Advantage. It also assists with selecting particular HMO, PPO or PFFS plans meeting healthcare and financial needs.

Compare Supplemental Plans Providing Added Coverage

To receive thorough insurance protection, many enroll in supplemental Medicare plans helping pay leftover healthcare costs. Two main options include:

Medigap: Private insurers sell standardized Medigap policies labeled Plan A through Plan N providing varied levels of coverage for Medicare copays, coinsurance and deductibles.

Medicare Select: Sold by private insurers, these plans function similar to Medigaps but usually at lower premiums, yet require using network providers to receive full benefits.

When reviewing supplemental plans, watch for differences in pricing structures, specific benefits provided per plan and restrictions to qualify. Certain options make sense if you have complex health issues and want capped out-of-pocket maximums. More budget-friendly plans appeal to those simply seeking basic coverage.

See If You Qualify for Financial Assistance Paying Medicare Costs

While Medicare does not directly offer financial assistance, several programs do aid older adults and people with disabilities struggling to afford Medicare. Options to explore include:

- Medicaid dual eligibility programs paying some or all Medicare costs based on strict income and asset limits per state.

- Medicare Savings Programs helping pay Part A/B premiums, deductibles and copays for those meeting income and resource criteria.

- Extra Help from Social Security assisting severely limited-income adults with Part D prescription drug costs covering premiums, deductibles and copays.

- Pharmaceutical company Patient Assistance Programs providing certain brand-name medications at no or low out-of-pocket expense to eligible applicants.

Checking if you qualify for financial help allows affording whichever Medicare plan best fits healthcare priorities.

Use Smart Strategies to Choose the Optimal 2023 Medicare Plan

Rather than get overwhelmed, follow key steps to determine suitable Medicare coverage this year:

- Learn basics of Original Medicare vs. Medicare Advantage plan options

- Use Medicare Plan Finder to compare Part D prescription drug plans

- Connect with experts like SHIPs for guidance on Medicare choices

- Review Medigap and Medicare Select plans providing supplemental insurance

- See if you meet eligibility for programs helping pay Medicare costs

Employing resources and understanding how Medicare plans differ make it easier to select coverage meeting unique health needs and financial situations in 2024. Reaching out for assistance also ensures not missing potential savings opportunities.